Sale Leaseback Tax Treatment

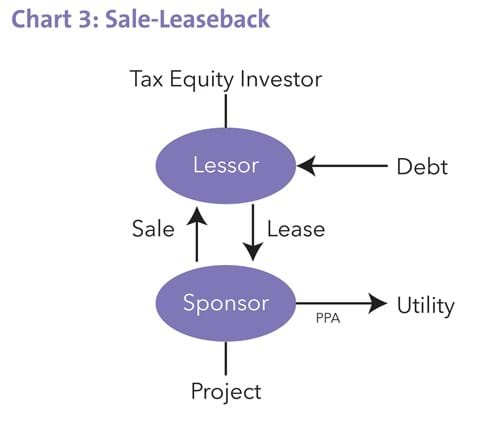

Sale leaseback tax treatment. 262 The buyer-landlord in a sale-leaseback as a real property owner still derives beneficial tax treatment. 1 Whether a saleleaseback transaction should be respected for federal income tax purposes depends on whether the benefits and burdens of ownership have passed to the purported buyer which must be ascertained from all of the facts and circumstances. As such if a sale is recognized under ASC 606 and ASC 842 the full profit or loss may thus be recorded by the seller-lessee.

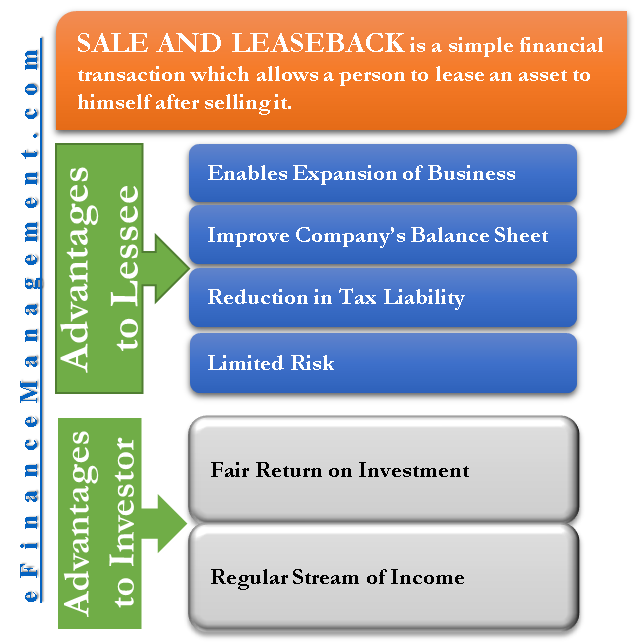

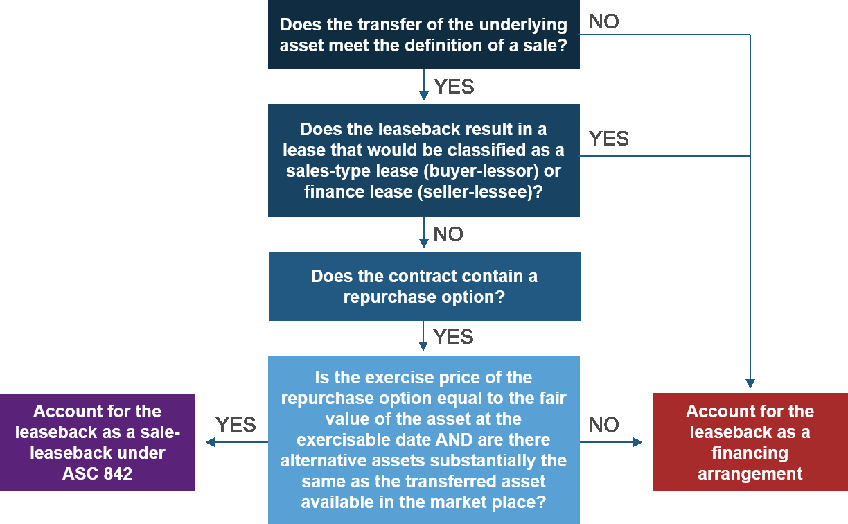

Transaction is imbued with considerations beyond mere tax deductions a sale-leaseback transaction has a greater chance of being respected for tax purposes. Sale-leasebacks Under ASC 842 Accounting for sale-leaseback transactions under ASC 842 aligns the treatment of an asset sale with ASC 606 pertaining to revenue recognition. W hile sale-leaseback transactions may be structured in a variety of ways a basic sale-leaseback can benefit both the sellerlessee and the buyerlessor.

If you cannot see the tabs use your browsers main scrollbar to scroll down until they are visible. The aforementioned means that in the case of concluding a sale and leaseback transaction when it will be considered a single financial transaction from the VAT point of view real estate transfer tax will also be due in the case of new constructions and unbuilt building land which have so far been taxed with VAT. A leaseback or sale leaseback SLB is an arrangement between two parties.

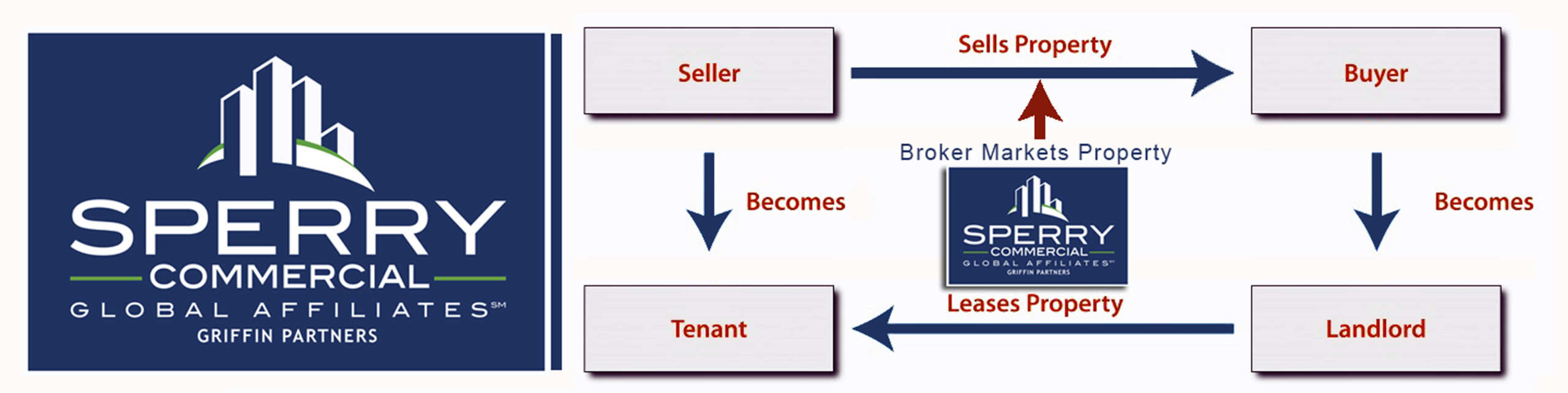

Then the sellerlessee leases the asset back from the buyerlessor. As illustrated above in a sale and leaseback transaction the machine owned by the seller remains on the sellers premises at all times. Specifically one party the sellerlessee that owns an asset sells the asset to the second party the buyerlessor.

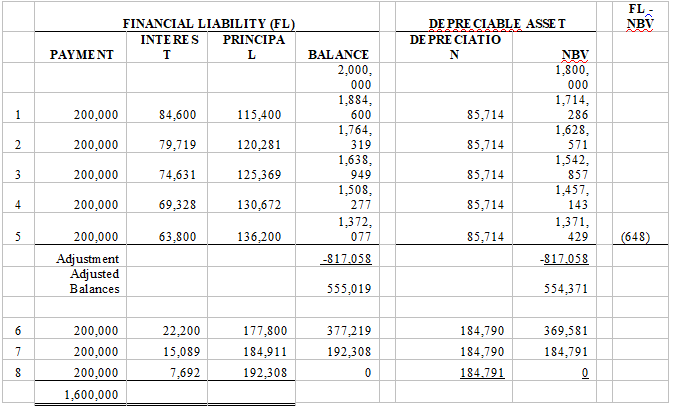

However all parties must consider the business and tax advantages disadvantages and risks involved in this type of arrangement before moving forward. Sale and finance leasebacks on or after 9 October 2007. IFRS 16 makes significant changes to sale and leaseback accounting.

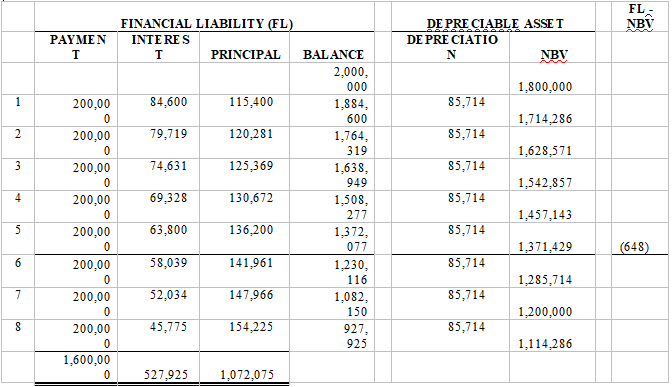

Some of the factors taken into consideration by Courts in finding sale-leaseback transactions valid for federal tax purposes include the need for capital and the existence of regulatory or. Rental income may be offset in part with available deductions and credits. Seller-lessees and buyer-lessors adjust the sale amount if it is not at fair value.

In valid sale-leaseback transactions the sellerlessee sells the business property to the buyerlessor who immediately in turn enters into a lease agreement to lease the property back from the sellerlessee. In a sale and leaseback transaction an entity the seller-lessee sells an asset to another entity the buyer-lessor which then leases the asset back to the seller-lessee.

In valid sale-leaseback transactions the sellerlessee sells the business property to the buyerlessor who immediately in turn enters into a lease agreement to lease the property back from the sellerlessee.

If so neither party may receive the benefit of its bargain. Then the sellerlessee leases the asset back from the buyerlessor. However all parties must consider the business and tax advantages disadvantages and risks involved in this type of arrangement before moving forward. Most importantly for the sale-leaseback transaction to be valid the buyerlessor must be treated as the true tax owner of the property. Sale and leaseback accounting. Some of the factors taken into consideration by Courts in finding sale-leaseback transactions valid for federal tax purposes include the need for capital and the existence of regulatory or. The aforementioned means that in the case of concluding a sale and leaseback transaction when it will be considered a single financial transaction from the VAT point of view real estate transfer tax will also be due in the case of new constructions and unbuilt building land which have so far been taxed with VAT. 262 The buyer-landlord in a sale-leaseback as a real property owner still derives beneficial tax treatment. Transaction is imbued with considerations beyond mere tax deductions a sale-leaseback transaction has a greater chance of being respected for tax purposes.

Specifically one party the sellerlessee that owns an asset sells the asset to the second party the buyerlessor. The IRS and the courts typically view sale-leaseback transactions as. Transaction is imbued with considerations beyond mere tax deductions a sale-leaseback transaction has a greater chance of being respected for tax purposes. In a sale and leaseback transaction an entity the seller-lessee sells an asset to another entity the buyer-lessor which then leases the asset back to the seller-lessee. This workbook contains three worksheets. Depending on how the parties structure the sale-leaseback transaction the IRS andor the courts may require the parties to forgo important tax deductions. W hile sale-leaseback transactions may be structured in a variety of ways a basic sale-leaseback can benefit both the sellerlessee and the buyerlessor.

.jpg)

Posting Komentar untuk "Sale Leaseback Tax Treatment"